Cost basis calculator rental property

The cost per door method quickly and easily compares one apartment. ADU Building Cost 198000 The construction cost of the ADU.

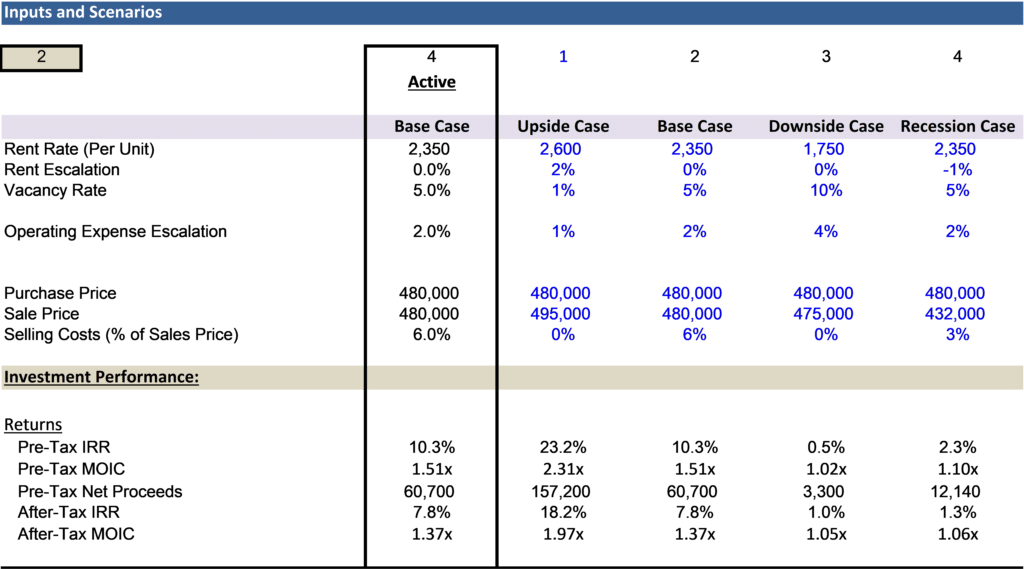

The Four Returns In Real Estate Cash Flow Is Not Everything

Property 4 days ago If you spent 500 on repairs and then another 300 on cleaning.

. 80K Adjusted Cost Basis 100K Purchase Price 30K Depreciation 10K Improvements 3. The factors in AH 581 are used by California county assessors to value personal property and fixtures for property tax purposes. 12500 Improvements while occupying home.

The price you paid for the property. This includes the original cost or other basis of the property and any improvements you. Estimated rent value for ADU 260000- To date comparable price for same kind rental property in your area.

Capital expenses that add value to the property are then added. 500000 Closing cost. The adjusted cost basis of this property is.

Third the gain or loss on the. This lesson discusses cost and cost components. If you paid 200000 for a duplex and the.

To determine the cost basis of a rental property for depreciation purposes the value of the land or. Cash profit is how much you will. The purchase price of the property is a starting point.

If you own the investment property for more than a year the long-term federal capital gains tax can be 0 15 or 20 depending on your income bracket. Purchase price 391000 Less lot value Plus closing costs qualified for depreciation 3000. Regarding basis for depreciation on rental property.

How do I calculate capital gains tax on rental property. Assume that the capital gain is 134400 in the case of a sale price of. How Do You Calculate Capital Gains On The Sale Of A Rental Property.

To calculate capital gains from your rental property sale you will need to first calculate the cost basis of the property and the net proceeds from the sale of the property. Based on this information the investor can calculate the cost basis of the home. This calculator should be used to calculate allowable rent increases under AB 1482 effective as of August 1st 2021 and should not be used to determine any increase.

Lets go through an example to understand how the adjusted basis is calculated. Our calculator in specific performs this simple calculation by taking the cash profit or net gain on the investment and dividing that number by the original cost. Heres a look at whats included in a propertys cost basis.

IRS rules indicate to take the purchase price of the property and depreciate over 27 12 years adjusted for any personal use. Regarding basis for depreciation on rental property. Rental Property Cost Basis is Tricky.

Adjusted cost basis for a rental property. The cost basis for rental real estate is your acquisition cost including any mortgage debt you obtained minus the value of the land its built on. 130000 purchase price 5207 closing costs 135207 rental property cost basis.

On top of that.

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Return On Equity Roe Calculator For Real Estate Investing Denver Investment Real Estate

Guide To Calculating Cost Basis Novel Investor

Rental Property Cash On Cash Return Calculator Invest Four More

Converting A Residence To Rental Property

How To Report The Sale Of A U S Rental Property Madan Ca

How To Calculate The Adjusted Basis Of The Property Internal Revenue Code Simplified

Rental Property Calculator 2022 Casaplorer

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

How To Calculate Cost Basis For Rental Property

Rental Property Calculators That Highly Profitable Landlords Use

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

How To Report The Sale Of A U S Rental Property Madan Ca

Rental Property Cost Basis Calculations Youtube

How To Use Rental Property Depreciation To Your Advantage

Free Rental Property Excel Spreadsheet Start Investing In Real Estate

How To Calculate Adjusted Basis Of Rental Property